Renters in the GTA Missed Out on up to $186,000 This Past Year - November 4, 2021

Ian Walterhouse

Thursday, November 4, 2021

Renters in the GTA Missed Out on up to $186,000 This Past Year

Rents have increased significantly this year. The latest news release from TREBB shows rents are rising at a fast rate due to low supply and high demand.

“We have seen a dramatic resurgence in rental demand this year. This demand will be augmented in 2022 and 2023 by record levels of immigration. Unfortunately, the supply of rentals is not keeping pace...GTA municipalities and the Ontario government must work collaboratively to streamline the planning and development approvals process to alleviate the current supply backlog and to meet the needs of today – let alone the needs of tomorrow,” said TRREB President Kevin Crigger.

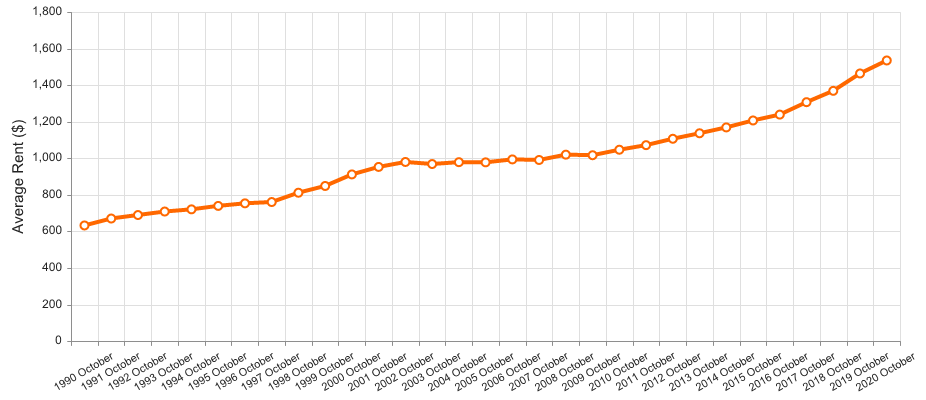

Looking back, we can see rents rising isn’t new. The median rental price has increased consistently over the past 40 years (see graph below):

Source: Canada Mortgage and Housing Corporation

If you’re thinking of renting for another year, consider that rents will likely be even higher next year. But that alone doesn’t paint the picture of the true cost of renting.

The Money Renters Stand To Lose This Year

A homeowner’s monthly mortgage payment pays for their shelter, but it also acts as an investment. That investment grows in the form of equity as a homeowner makes their mortgage payment each month to pay down what they owe on their home loan. Their equity gets an additional boost from home price appreciation, which is at near-record levels this year.

The latest insights from the Toronto Regional Real Estate Board news release on November 3, 2021 shows that homeowners gained significant wealth through their home equity this past year. The research shows that the MLS Home Price Index Composite Benchmark was up by 24.2 per cent year over year. Detached houses increased by 28.5 per cent. The average selling price for all homes types combined rose by 19.3 per cent.

That means that if homeowners sold their house in October 2021, they would have gained, on average, just over $186,000 more than if they had sold in October 2020.

As a renter, you don’t get the same benefit. Your rent payment only covers the cost of shelter and any included amenities. None of your monthly rent payments come back to you as an investment. That means, by renting this year, you likely paid more in rent than you did in the previous year, and you also missed out on the potential wealth gain of nearly $200,000 you could have had by owning your own home.

Bottom Line

When deciding whether you should rent or buy in the future, keep in mind how much renting can cost you. Another year of renting is another year you’ll pay rising rents and miss out on building your wealth through home equity. Let’s connect today to talk more about the benefits of buying over renting. Give me a call to talk about your options and the best plan for you - 416-522-1112.

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !