3 Reasons Why Today’s Housing Market Isn’t Like 2008 or 2017 - Thursday October 27, 2022

Ian Walterhouse

Thursday, October 27, 2022

Given yesterday’s Bank of Canada 0.5% interest rate increase and with all the headlines and talk in the media about the shifts in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place in the recent past. But the good news is, there’s concrete data to show why this is nothing like the last time.

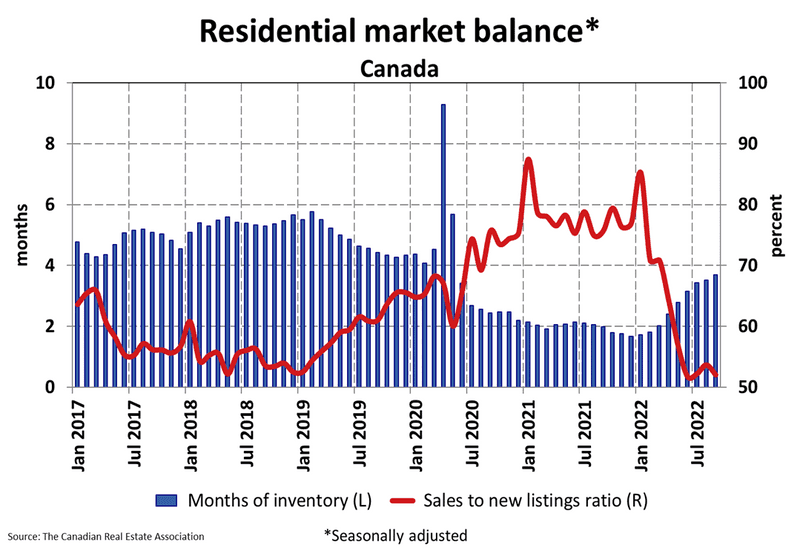

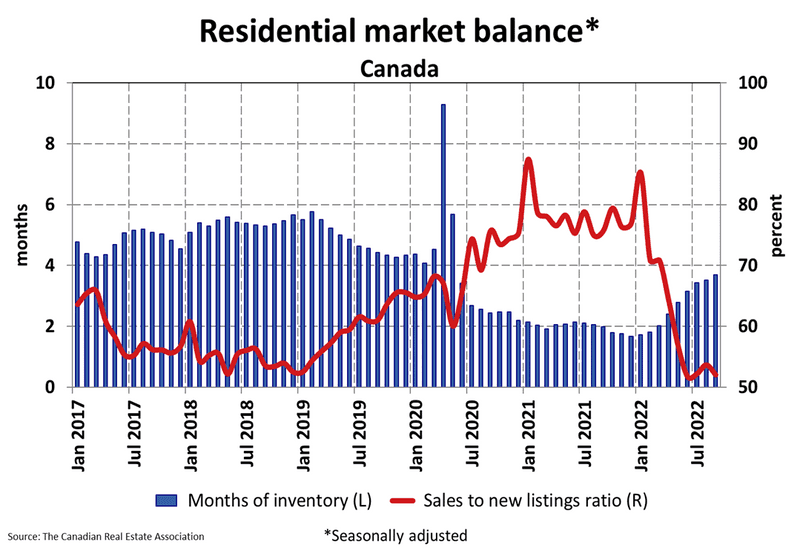

The graph below uses data from the Canadian Real Estate Association (CREA) to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just a 3.7-months’ supply at the current sales pace, which is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to come crashing down like they did last time, even though some overheated markets may experience slight declines.

During the lead-up to the housing bubbles, it was easier to get a home loan than it is today. Running up to 2006, banks were making it easier for people to qualify for a home loan or refinance their current home.

Back then, lending institutions took on greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face higher standards from mortgage companies. In Canada, this is due in part to the stress test launched by the Federal Government in 2017 to cool down the overheated market at the time. The stress test is the minimum threshold that anyone applying for a home loan in Canada has to meet. It does not make the home anymore expensive, rather it works to ensure that those who qualify for a mortgage will be able to pay it off as rates go up.

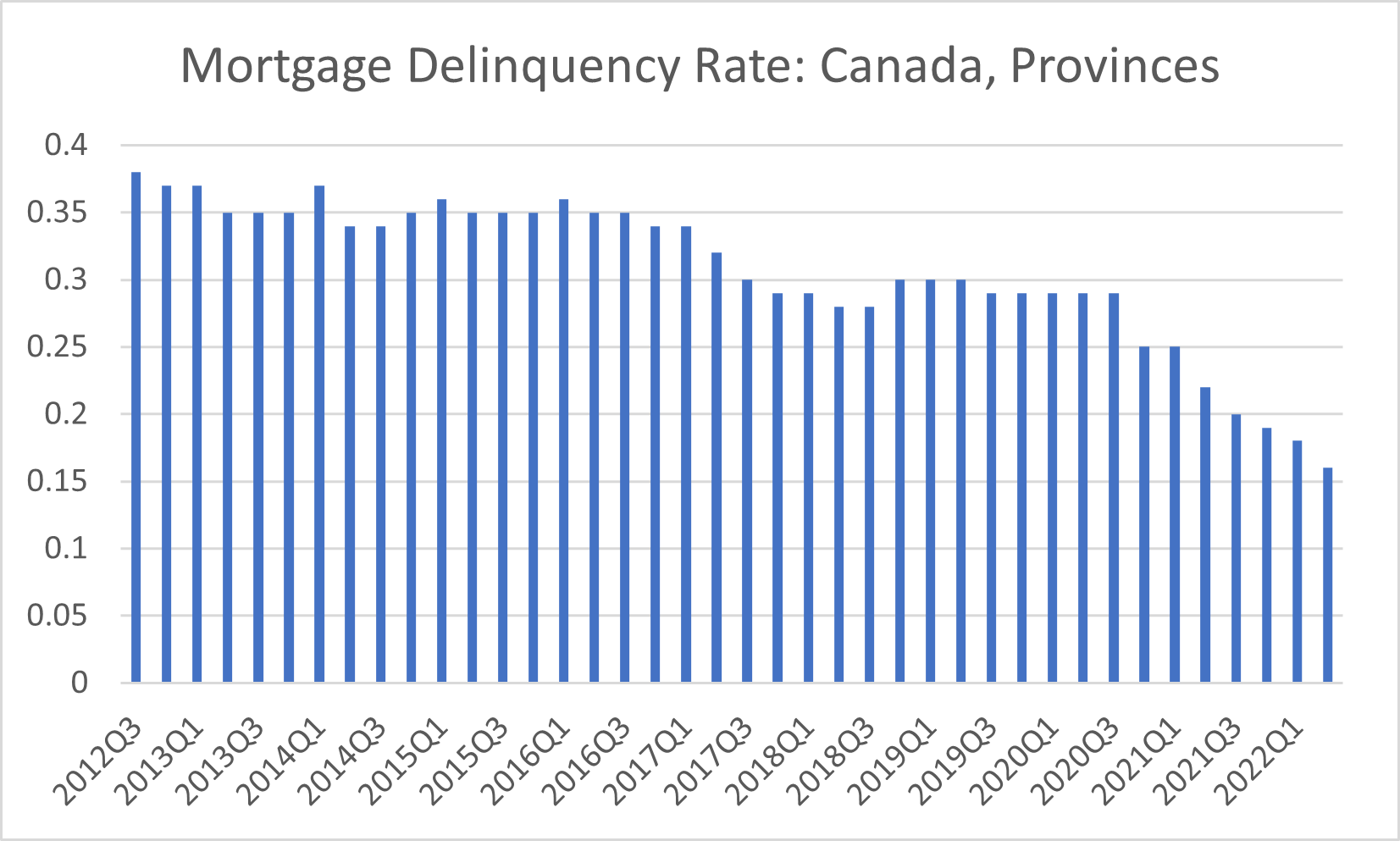

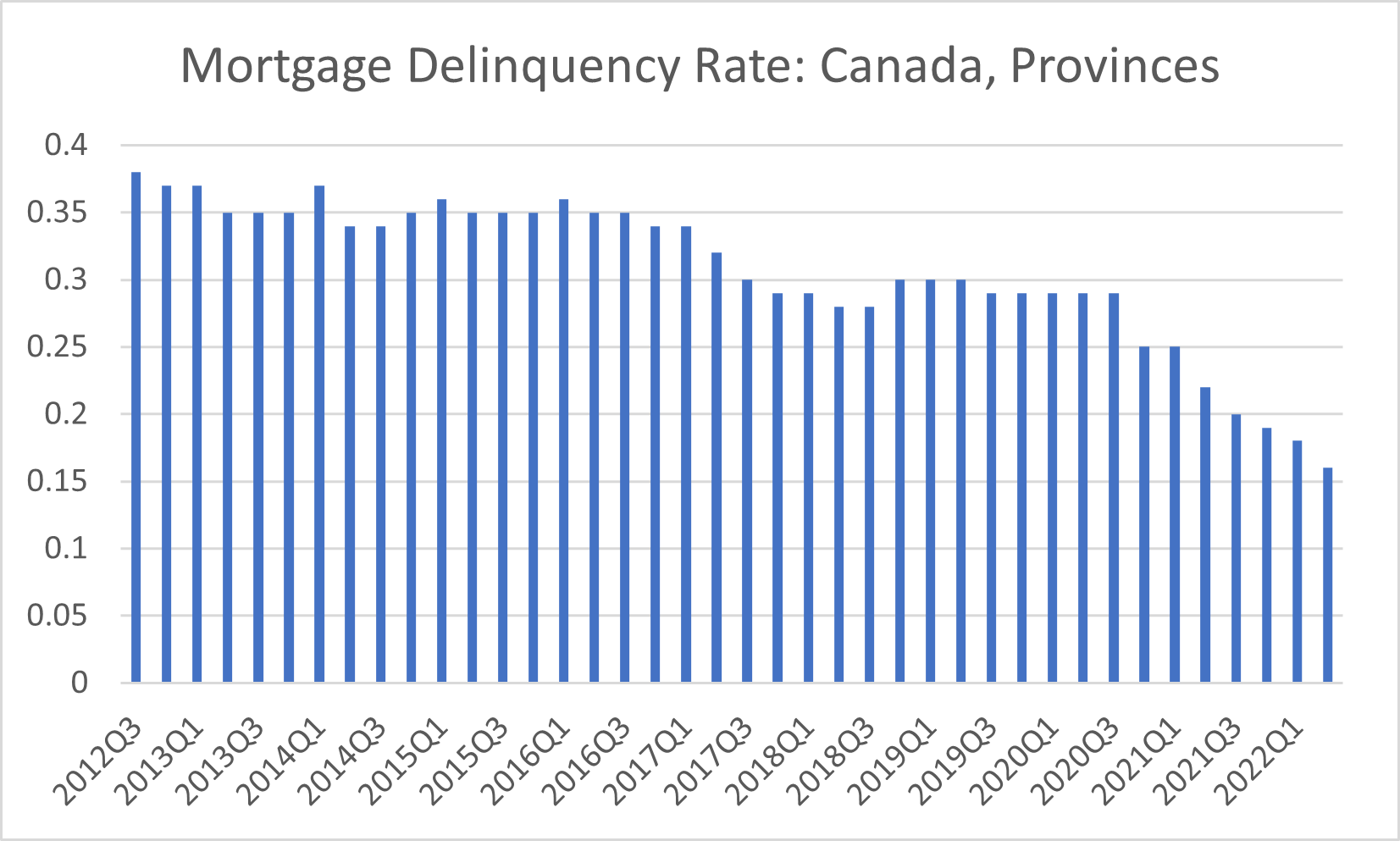

Another difference is the number of homeowners that were facing mortgage delinquency after the housing bubble burst. According to Canadian Real Estate Wealth, mortgage delinquency does not immediately mean you will lose your home. Most lenders will offer repayment plans to make up for missed payments. Over time, if your lender chooses, they may take legal action after a missed payment, especially after multiple missed payments. Lenders may go so far as to exercise power-of-sale or foreclosure and sell your home, forcing you to move. You will also be on the hook for paying legal fees and any fees as a result of defaulting on your lease agreement.

Mortgage delinquency activity has been lower since the crash, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from the Canadian Mortgage and Housing Corporation to help paint the picture of how different things are this time:

Not to mention, homeowners today have options they just didn’t have previously due to the unprecedented growth in home equity. That equity comes, in large part, from the way home prices have appreciated over time.

This all goes to show homeowners are in a completely different position this time. For those facing challenges today, many have the option to use their equity to sell their house and avoid the foreclosure process.

If you’re concerned we’re making the same mistakes that led to the housing crash, the graphs above should help alleviate your fears. Concrete data and expert insights clearly show why this is nothing like the last time.

There’s Still a Shortage of Homes on the Market Today, Not a Surplus

For historical context, there were too many homes for sale during the last market corrections (bubbles) in 2008 and in 2017 that caused prices to fall. In 2017 alone, the Toronto real estate market started the year with home prices up 34% in March over the previous year, then saw prices fall 18% in just four months when the bubble burst. Today, supply has increased since the start of this year, but there’s still a shortage of inventory available overall, primarily due to almost 15 years of underbuilding homes.

The graph below uses data from the Canadian Real Estate Association (CREA) to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just a 3.7-months’ supply at the current sales pace, which is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to come crashing down like they did last time, even though some overheated markets may experience slight declines.

Mortgage Standards Were More Relaxed Back Then

During the lead-up to the housing bubbles, it was easier to get a home loan than it is today. Running up to 2006, banks were making it easier for people to qualify for a home loan or refinance their current home.

Back then, lending institutions took on greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face higher standards from mortgage companies. In Canada, this is due in part to the stress test launched by the Federal Government in 2017 to cool down the overheated market at the time. The stress test is the minimum threshold that anyone applying for a home loan in Canada has to meet. It does not make the home anymore expensive, rather it works to ensure that those who qualify for a mortgage will be able to pay it off as rates go up.

Mortgage Delinquency Volume Is Nothing Like It Was During the Crash

Another difference is the number of homeowners that were facing mortgage delinquency after the housing bubble burst. According to Canadian Real Estate Wealth, mortgage delinquency does not immediately mean you will lose your home. Most lenders will offer repayment plans to make up for missed payments. Over time, if your lender chooses, they may take legal action after a missed payment, especially after multiple missed payments. Lenders may go so far as to exercise power-of-sale or foreclosure and sell your home, forcing you to move. You will also be on the hook for paying legal fees and any fees as a result of defaulting on your lease agreement.

Mortgage delinquency activity has been lower since the crash, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from the Canadian Mortgage and Housing Corporation to help paint the picture of how different things are this time:

Not to mention, homeowners today have options they just didn’t have previously due to the unprecedented growth in home equity. That equity comes, in large part, from the way home prices have appreciated over time.

This all goes to show homeowners are in a completely different position this time. For those facing challenges today, many have the option to use their equity to sell their house and avoid the foreclosure process.

Bottom Line

If you’re concerned we’re making the same mistakes that led to the housing crash, the graphs above should help alleviate your fears. Concrete data and expert insights clearly show why this is nothing like the last time.

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !